SINGLE UNIT COST FOR PERSONNEL COSTS

A NEW METHOD IN HORIZON EUROPE

The 15th of January 2024, Mr. Marc Lemaitre, Director-General of DG R&I published a decision authorizing the use of unit costs for personnel costs for actions under Horizon Europe and Euratom Programmes in a sole Article. “The use of eligible costs declared by recipients of Union funds on the basis of unit costs for personnel costs is authorised for all actions under the Horizon Europe and Euratom Programmes where actual personnel costs are eligible, for the reasons and under the conditions set out in the Annex. The new unit costs shall apply only following the approval of the unit cost requests submitted as of 1 May 2024.”

https://efmc.eu/wp-content/uploads/2024/04/240325-unit-cost-decision-personnel-costs_horizon-euratom_en.pdf

The Director-General of DG R&I presented this new methodology as “The new cost method introduced for calculating personnel unit costs intends to represent a significant step towards administrative simplification, efficiency improvement, and error reduction in the management of EU funds. This detailed explanation aims to provide a comprehensive overview of the initiative, highlighting its objectives, methodology, and implications for grant beneficiaries.

However, the administrative complexity associated with managing these grants, particularly in calculating and declaring personnel costs, has been a significant challenge for beneficiaries. Personnel costs, constituting the majority of eligible expenses in most actions, have traditionally required detailed and often cumbersome documentation and verification processes.”

This decision is bringing a 3rd option in the calculation of the personnel costs: 1/ Calculation of a daily rate per reporting period, 2/ calculation of a daily rate per financial year and 3/ a single unit cost at legal entity level for at least 2 year. The selection of 1 of these option will have a huge financial impact on your cost declaration depending on the structure of your organization.

Now, let´s go deeper in the analysis of this unit cost by explaining the calculation methodology and the process to get awarded this certificate. This article will also indicate some of the constraints, the advantages and disadvantages and the consequences for your cost declaration.

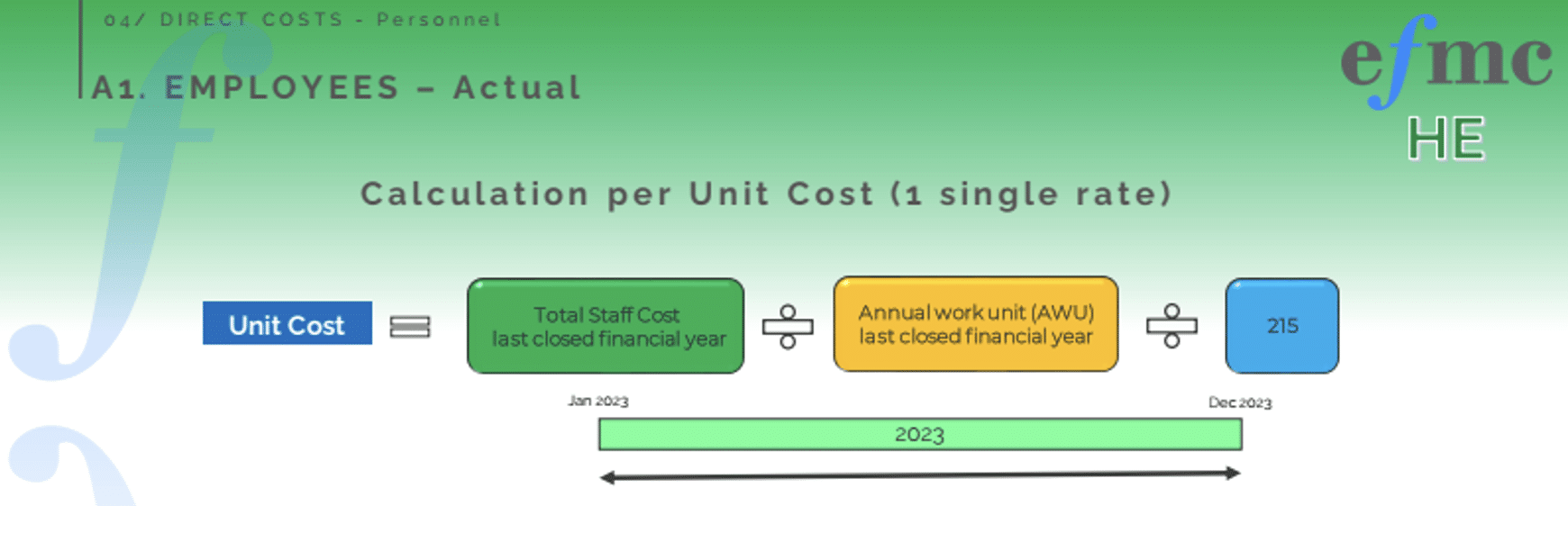

1. Calculation of the unit cost

The methodology for the calculation is quite simple.

1.1. Total staff cost

First of all, the beneficiary must calculate the total personnel costs of the previous closed financial year at the legal entity level. The beneficiary must integrate the entire of the payroll for the whole organization, integrating the data of all the employees, even those who are not working in any EU Actions (Total Staff Cost).

1.2. AWU

This amount shall be then divided by the number of Annual Work Unit (AWU).The AWU is defined in Article 5 of the Annex to Commission Recommendation (OJ L 124, 20.05.2003) as follow: “The headcount corresponds to the number of annual work units (AWU), i.e. the number of persons who worked full- time within the enterprise in question or on its behalf during the entire reference year under consideration. The work of persons who have not worked the full year, the work of those who have worked part-time, regardless of duration, and the work of seasonal workers are counted as fractions of AWU. The staff consists of:

(a) employees;

(b) persons working for the enterprise being subordinated to it and deemed to be employees under national law;

(c) owner-managers;

(d) partners engaging in a regular activity in the enterprise and benefiting from financial advantages from the enterprise.

Apprentices or students engaged in vocational training with an apprenticeship or vocational training contract are not included as staff. The duration of maternity or parental leaves is not counted.”

To summarise, the AWU represents the overall workable (not productive) hours for all personnel full-time and part-time.

1.3. 215 days

The amount of the personnel divided by the AWU shall then be divided by 215. This calculation will give the single daily rate.

This daily rate will be the single one that the beneficiary will have to use for all the employees working on the Horizon Europe action, no matter the position and the actual salary paid to the employee.

The methodology ensures that the unit cost reflects the average expenditure on personnel, providing a straightforward and fair basis for cost declaration.

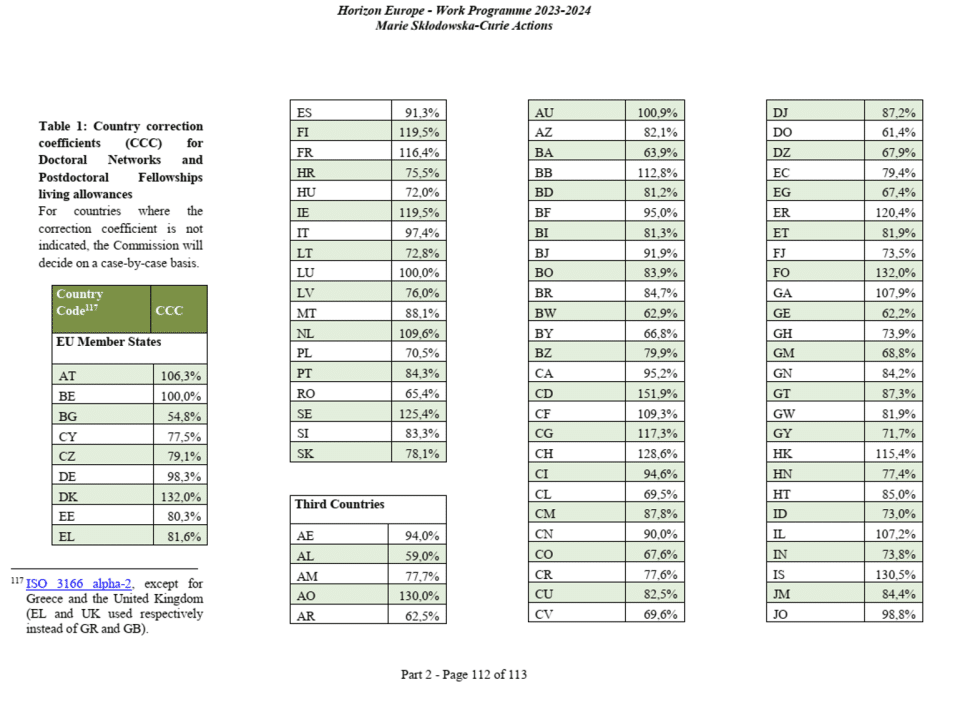

Now, to ensure the representativeness of the unit costs and prevent excessively high declarations, a first cap is applied. The DG R&I decided to consider the coefficient for unit costs for Doctoral Network under MSCA: 9.618€ per month. To get the daily rate, this amount shall be divided by 18 days and then multiplied by the country correction coefficients (CCC).

As an example, the maximum daily rate accepted for Ireland would be 9.618€ / 18 x 119,5% = 638,53€ per day when for Estonia it would be 9.618€ / 18 x 80,3% = 429,07€ per day.

The unit cost is valid for at least 2 years. After 2 years, the Beneficiary might decide to update the unit cost but to do so, the whole process will need to follow the same process than the first demand. The last date for the update will be the 31.12.2027.

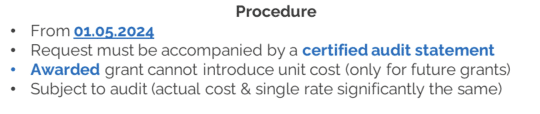

2. Procedure for Request and Approval Process

A beneficiary wishing to use the unit cost method must submit a request via the Funding & Tenders Portal, starting from 1 May 2024. The procedure will be the following:

1/ The beneficiary will use a wizard to calculate the unit cost,

2/ The request includes an independent audit certificate certifying the calculation parameters of the unit cost, ensuring transparency and compliance. This certificate shall be provided by a “qualified approved external auditor” and the “verification must be carried out according to the highest professional standards”,

3/ The “Responsible Service” (we guess it is the audit unit but this needs to be confirmed), will “verify, before approval, that the figures entered in the wizard are those certified by the audit certificate”.

4/ Approval of the request

The beneficiary may withdraw at any time until the demand is approved. But once the approval is delivered, the beneficiary may revert to actual costs only once, only for future grants and with no possibility to request again the unit cost.

Once the approval is validated, the unit cost shall be implemented to ALL Horizon Europe and Euratom proposal submitted (awarded after the date of the approval). Therefore, it does not concern any awarded or ongoing project.

Upon verification and approval, the unit cost becomes applicable to all future Horizon Europe and Euratom proposals submitted by the beneficiary.

Checks and controls

The unit cost is of course subject to check, review, audit or investigation to verify that the unit cost is recurrently and significantly higher than the actual costs. In such situation, the auditors will withdraw the unit costs, reverting to actual cost methodology.

3. Consequences for the beneficiary

The introduction of the unit cost methodology will of course simplify the personnel cost calculation. The unit cost method offers several advantages, including:

- Reduced Administrative Burden: By simplifying the calculation and declaration of personnel costs, the method significantly reduces the administrative workload on beneficiaries, enabling them to focus more on their research and innovation activities.

- Increased Accessibility: Simplifying the cost declaration process makes the Horizon Europe and Euratom Programmes more attractive and accessible, particularly to smaller entities that may have been deterred by the complexity of the previous system.

- Error Reduction: The straightforward calculation method minimizes the risk of errors in cost declarations, contributing to more efficient fund management and allocation.

Now, it is important to have in mind the important negative financial impact on the cost declarations of the beneficiaries.

First of all, this methodology does not take into consideration of the specificities of some business sectors (IT, defense, advanced technologies…) where the average personnel cost is much higher than the Doctoral Network under MSCA. So the capping might have a significant negative impact on selecting this methodology for innovative organisations.

Additionally, the unit cost is awarded for at least 2 years and does not integrate the natural increase of salary of the employees (promotion, inflation, recruitment of higher qualified employees…). As an example, let´s say a beneficiary would like to implement the unit cost from 2024. He will submit the certificate from 01.05.2024. Unfortunately, the average personnel cost data will be the one from 2023 (last closed financial year). If the unit costs is awarded from 09.2024, the beneficiary will have to use a rate of 2023 for costs declaration of 2024 (after 09.2024), 2025 and 2026. The following update would be in 2027, using the rate of 2026 until the end of the programme Horizon Europe (2027 + minimum 3 years = 2030).

Last but not least, the principle to use a unit costs (average personnel costs) is that sometimes the actual rate is higher, but sometimes can be lower too. Unfortunately, in case the rate would be recurrently and significantly higher than the actual costs this last situation, the European Commission might decide to withdraw the unit cost certificate and revert to the actual costs.

Conclusion

The introduction of a unit cost method for personnel costs in the Horizon Europe and Euratom Programmes marks a significant stride towards simplifying the administrative processes associated with EU grant management. By reducing the burden on beneficiaries and minimizing errors, this method not only streamlines the grant application and management process but also makes participation in these flagship programs more accessible to a broader range of entities. As the system is implemented and refined, it is expected to contribute significantly to the efficiency and effectiveness of EU-funded research and innovation efforts, ultimately fostering a more vibrant and inclusive European research community.

Unfortunately, the negative financial impact on the cost declaration of the beneficiary opting for this methodology will be very significant.